Gifts of Real Estate

Donate a valuable asset in exchange for powerful tax benefits and possibly an income stream for you and/or your loved ones.

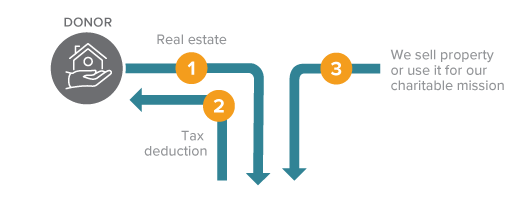

How It Works

- You deed your home, vacation home, undeveloped property, or commercial building to State College of Florida Foundation.

- State College of Florida Foundation may use the property or sell it and use the proceeds.

Benefits

- You receive an income tax deduction for the fair market value of the real estate.

- You pay no capital gains tax on the transfer.

- You can direct the proceeds from your gift to support the overall mission of State College of Florida Foundation.

Next

- You can donate your property yet continue to use it.

- More details about gifts of real estate.

- Frequently asked questions on gifts of real estate.

- Contact us so we can assist you through every step.